Investments | June 23, 2025

Whether it’s a sudden job loss, a major car repair, or an unexpected medical bill, an emergency fund can help you navigate financial storms without derailing your long-term goals. But how much should you save? And how do you get started? Let’s break it down.

Why an Emergency Fund Matters

An emergency fund is your personal financial safety net. It helps you cover unexpected expenses without going into debt or dipping into your long-term savings. Whether it’s a job loss, an urgent home repair, or a vet bill, this fund is there to support you through life’s surprises—big or small.

How Much Should You Save?

Everyone’s emergency fund will look a little different based on their lifestyle and expenses. A common recommendation is to save at least three months’ worth of necessary expenses, which typically includes:

- Rent or mortgage payments

- Utilities

- Groceries

- Insurance premiums

- Transportation costs

To calculate your ideal emergency fund, total your essential monthly expenses and multiply that by three. If possible, work toward saving six months of expenses, especially if you:

- Have a highly specialized job that might take longer to replace

- Live in an area with a high cost of living

- Are self-employed or lack other financial support

- Support dependents like children, elderly parents, or pets

- Own an older home or vehicle that may need repairs

Remember: there’s no upper limit on your emergency savings. More cushion equals more peace of mind.

How to Start Building Your Fund

If saving three to six months of expenses feels overwhelming, start smaller. Set an initial goal of $500 to $1,000, then build from there. You can use our savings goal calculator to estimate how long it might take to reach your emergency fund target .Here are some helpful strategies:

- Automate your savings: Set up recurring monthly transfers into a dedicated emergency fund.

- Save windfalls: Tax refunds, bonuses, or birthday cash can give your fund a nice boost.

- Cut unnecessary expenses: Reevaluate subscriptions or dining out habits and reroute those savings.

- Make saving a habit: Instead of focusing on a set dollar amount, aim to make saving a regular part of your routine.

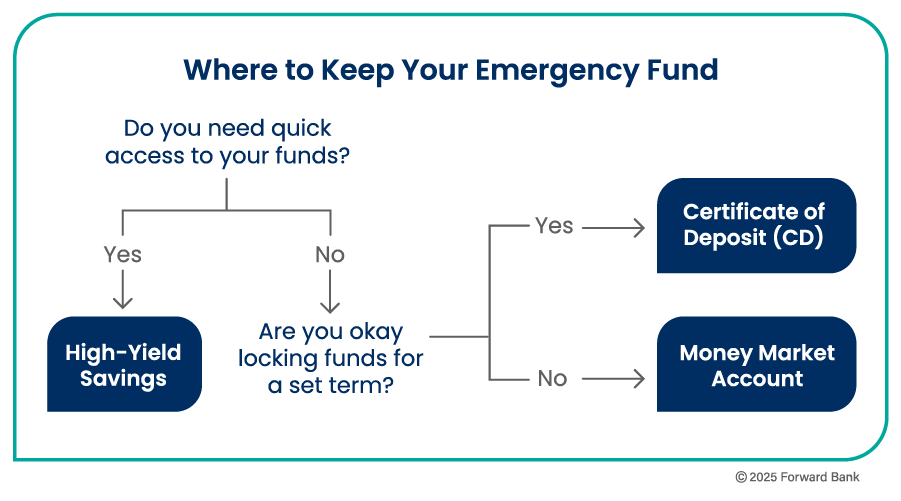

Where to Keep Your Emergency Fund

The best place for your emergency fund is somewhere safe, accessible, and separate from your everyday spending account. Common options include:

-

High-yield savings account: FDIC-insured, safe, and earns interest

-

Money market account: Offers slightly higher rates and check-writing privileges

-

CD (Certificate of Deposit): If you already have some savings set aside, a CD can earn more—but your funds are locked in for a set term

Avoid risky options like stocks or mutual funds for emergency savings. These can lose value and may not be liquid when you need them most.

(Learn more about FDIC deposit insurance and how it protects your savings.)

When Should You Use Your Emergency Fund?

Use your emergency fund only for true emergencies—unexpected, necessary expenses that can’t be avoided. Appropriate situations include:

- Sudden job loss or reduction in income

- Emergency medical expenses

- Essential home or auto repairs

- Unplanned travel due to family emergency

- Emergency pet care

Avoid dipping into your emergency fund for non-essentials like vacations, new gadgets, or impulse purchases. If you use funds, replenish them as soon as possible.

The Bottom Line

An emergency fund gives you financial flexibility when life doesn’t go as planned. Start small, stay consistent, and build toward a savings cushion that brings peace of mind—no matter what comes your way.

Whether you’re just getting started or working toward a bigger goal, every dollar saved adds up to a stronger, more secure future.

This article is for informational purposes only and should not be considered financial advice. Individual financial situations vary. Please consult with a financial professional before making any financial decisions.

Email

Email