Personal Banking | March 8, 2023

Opening or closing a credit card might seem like a small move, but it can have a surprising impact on your credit score. While any changes are usually temporary, being intentional with your credit card habits can help protect your score — and even improve it.

Here’s how to make smart decisions when adding or removing credit cards from your wallet.

What Makes Up Your Credit Score?

Understanding the factors that influence your credit score is key to managing it effectively. According to myFICO, here’s how your score is typically calculated:

- Payment History (35%)

- Amounts Owed / Credit Utilization (30%)

- Length of Credit History (15%)

- Credit Mix (10%)

- New Credit Inquiries (10%)

Want to understand why these factors matter? Check out why good credit is important to see how your credit score can affect your financial future.

When Opening a New Credit Card

Avoid the urge to overspend: A common mistake after opening a credit card is running up a balance. While it may be tempting to take advantage of a new limit or rewards, this can increase your overall credit utilization, which negatively affects your score.

A study found that nearly two-thirds of consumers who opened a new credit card increased their overall balance almost immediately. Those individuals saw their credit scores drop by an average of 14 points. On the other hand, people who opened a new card without increasing their balance saw their credit scores increase by an average of 11 points.

Tip: Use your new personal credit card sparingly and pay off the balance in full each month to boost your credit score over time. This builds a positive payment history and keeps your utilization low.

When Closing a Credit Card

Watch your credit utilization ratio: Your credit utilization ratio compares how much you owe to your total credit available. If you close a card, you reduce your available credit — which could cause your utilization to spike.

Let’s say you carry a $3,000 balance and have $10,000 in available credit (30% utilization). If you close a card with a $5,000 limit, your available credit drops to $5,000 — and your utilization jumps to 60%, which can negatively impact your score.

When closing a card may make sense:

- You’re paying a high annual fee with no benefit.

- The card encourages overspending.

- You’re consolidating and simplifying accounts.

If possible, keep the card open:

- Use it occasionally (e.g., for a streaming subscription).

- Pay off the balance in full each time.

- Keep it open to maintain your available credit and length of credit history.

How to Maintain a Strong Credit Score

Your credit score is influenced by several factors, including how much credit you’re using and how long you’ve had credit. By being strategic when opening or closing credit cards, you can protect — or even improve — your credit score over time.

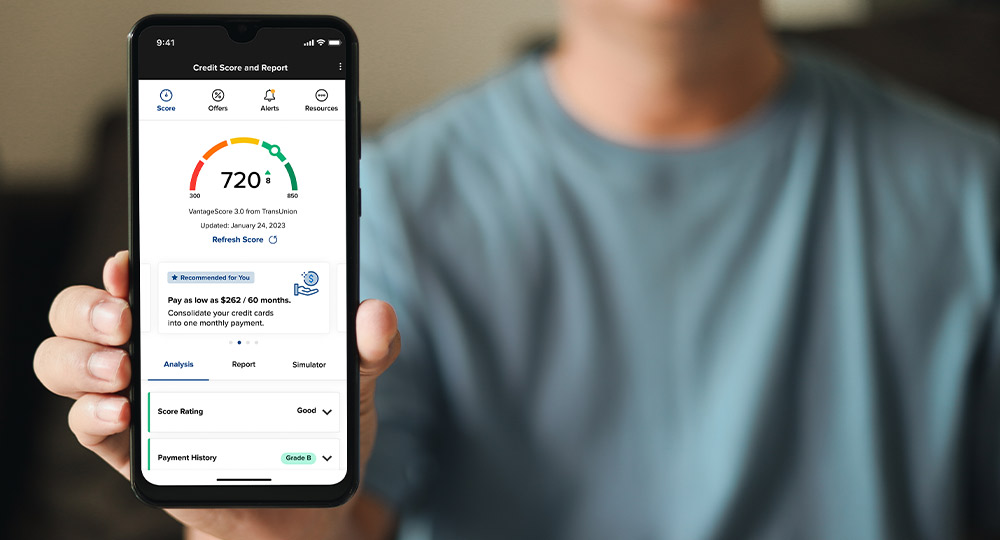

To stay on top of changes, consider using a tool like Credit Score Journey, available within digital banking at Forward Bank. It helps you track your score, understand what’s affecting it, and gives you tips to keep moving forward financially.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security.

Email

Email