Personal Banking | May 29, 2025

In a world that’s moving away from cash and becoming more dependent on credit, you’ve probably heard about the importance of your credit score. Whether you’re applying for a loan or looking for ways to boost your financial health, your credit score plays a major role.

What is a Credit Score?

A credit score is a three-digit number, typically ranging from 300 to 850, used by lenders to assess your creditworthiness. In simple terms, it tells lenders how likely you are to repay borrowed money based on your financial behavior.

Credit scores are calculated by credit bureaus like Equifax, Experian, and TransUnion using a mathematical formula that considers:

- Number of open accounts

- Total debt owed

- Repayment history

- Credit utilization

- Length of credit history

You’re entitled to one free credit report per year from each of the three major credit bureaus. Visit AnnualCreditReport.com to access your report safely.

Why is Good Credit Important?

A high credit score tells lenders you’re a reliable borrower, which unlocks a wide range of financial benefits. Whether you’re applying for a mortgage, renting an apartment, or financing a new car, your credit score can impact your options and your wallet.

Here are some of the advantages of maintaining a good or excellent credit score:

- Lower interest rates on loans and credit cards, which can save you thousands over time

- More terms and loan options, including higher approval odds and lower fees

- Easier approval for renting housing or setting up utility and phone services

- Better options for business loans and credit cards, helping entrepreneurs grow with confidence

In short, strong credit puts you in a better financial position, giving you access to more opportunities at better rates.

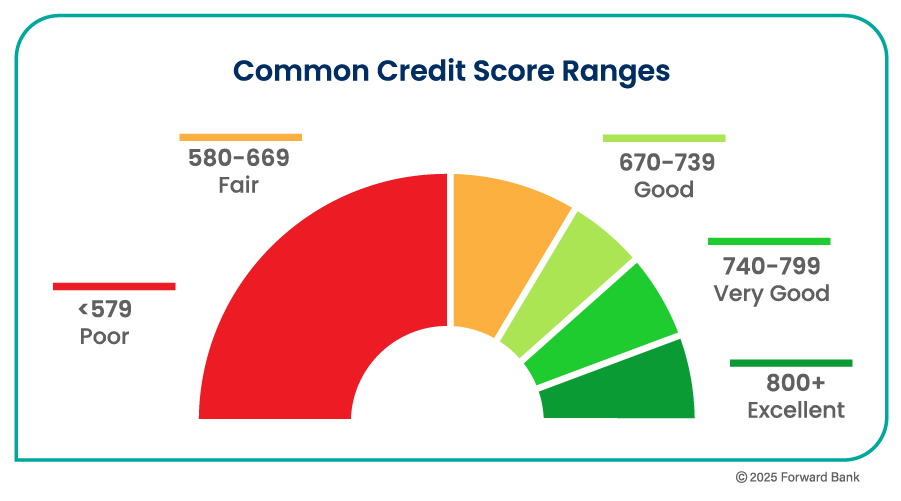

Credit Score Ranges

Understanding how your credit score ranks can help you set goals. Here’s how the ranges generally break down:

- Poor: 579 and below

- Fair: 580-669

- Good: 670-739

- Very Good: 740-799

- Excellent: 800 and above

How to Improve Your Credit Score

If your score isn’t where you’d like it to be, don’t worry—there are several ways to boost it over time:

-

Pay Your Bills on Time: On-time payments are one of the biggest factors in your credit score.

-

Increase Your Credit Limit: A higher limit can reduce your credit utilization ratio—just don’t use it as an excuse to spend more.

-

Keep Older Accounts Open: Even if you don’t use a card often, keeping it open can help your score by increasing the average age of your accounts.

-

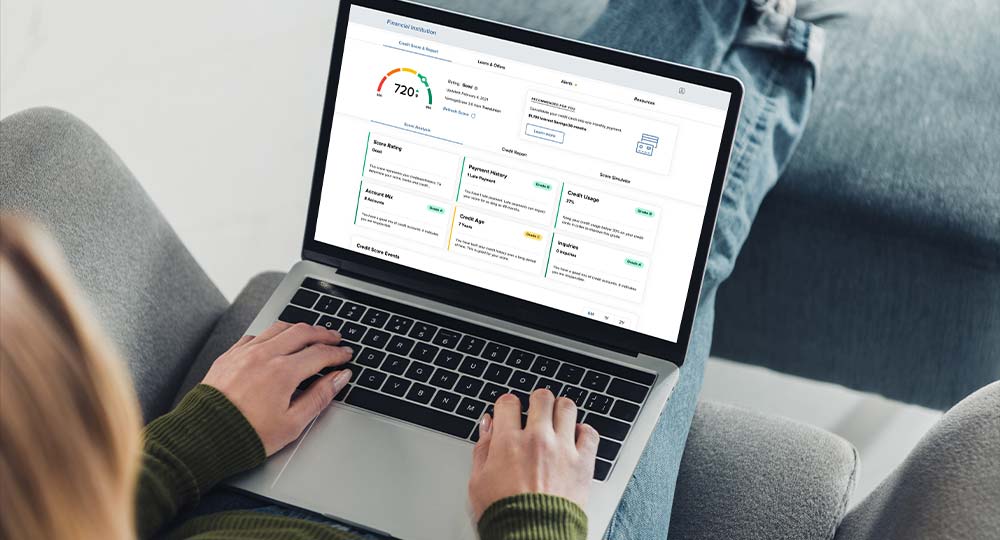

Monitor Your Credit Report: Check for errors or fraudulent activity that might be dragging down your score. Consider using a credit score tracking tool or app to monitor changes, receive alerts, and stay informed about the factors impacting your score.

Visit our digital banking tools to explore features like credit monitoring and online bill pay that can help you stay on top of your finances and improve your credit.

Ready to Take Control of Your Credit?

Our team is here to help you understand your credit score, build a plan to improve it, and reach your financial goals. Contact us today to get started.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security.

Email

Email